Meet the members of our staff and discover the vision and values that drive our work.

ADA Health Policy Institute

The ADA Health Policy Institute (HPI) is a thought leader for critical policy knowledge about the U.S. dental care system.

Thought leadership for better oral care

The Health Policy Institute (HPI) conducts innovative studies on a wide range of topics on the U.S. dental economy.

HPI's Research Topics

HPI’s Economic Outlook and Emerging Issues in Dentistry tracks dentists' perspectives.

Publications on dental care utilization and expenditures across the U.S.

Research on dental practice modality, dentists' earnings and reimbursement trends.

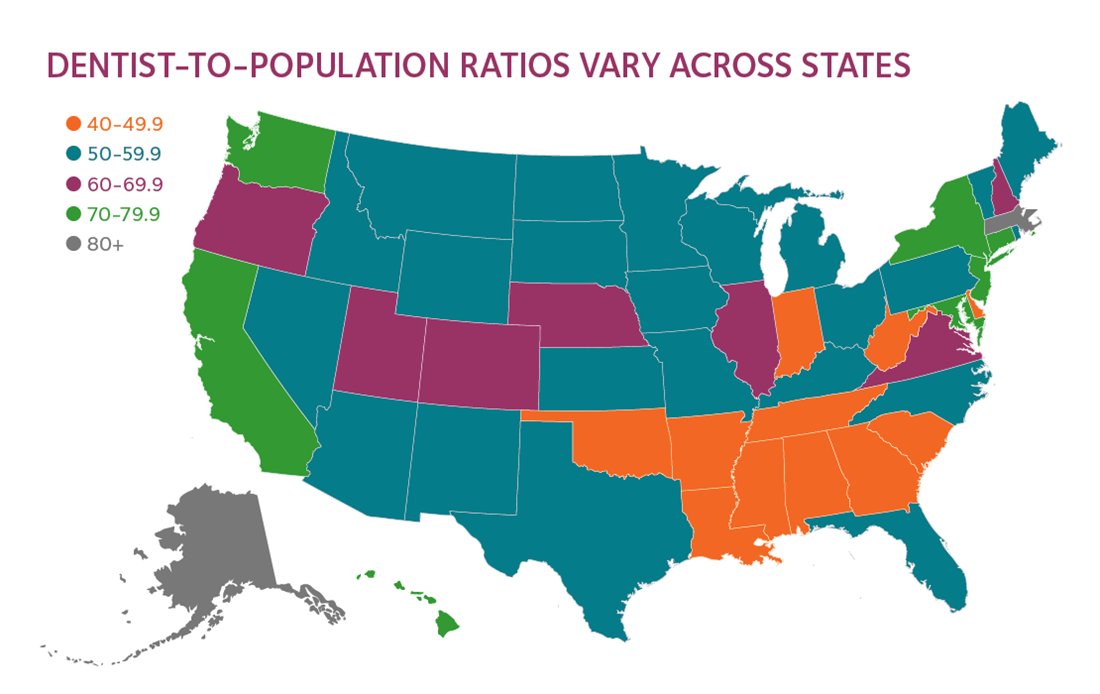

Trends in the current and future supply of dentists and Dentist Demographics Dashboard.

Dental student demographic trends and other data on CODA-accredited dental education programs.

Research on dental benefits, access and barriers to care, and oral health outcomes.

HPI in the news

Browse the latest media coverage that cites HPI findings and reports.

Tools for policymakers

Crucial information for oral health policymakers and advocates.

HPI Consulting

Custom research and resources for leaders of large group practices, dental insurers, manufacturers and other decision makers.